Stamp Duty Changes

You could save thousands of pounds buying a house with Stamp Duty changes

- no Stamp Duty to pay if you are purchasing a property under £500,000 in England or Northern Ireland until 1st April 2021

Our property experts will help You capitalise on this money saving opportunity

Free Phone 0800 298 5424 today

Save money when buying your next home with the Stamp Duty Changes

At last some money saving good news from the government if you are buying a new home post COVID-19

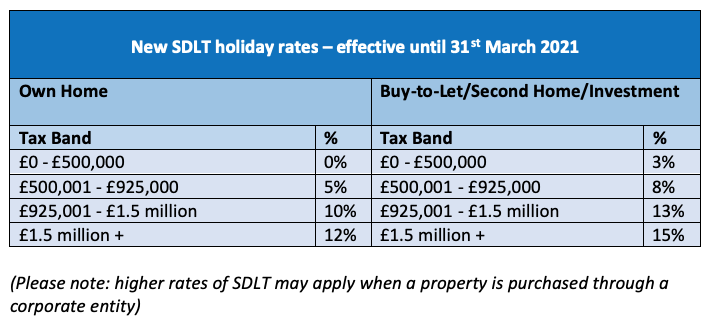

To help house buyers the Chancellor of the Exchequer Rishi Sunak announced on 8th July 2020 an immediate stamp duty holiday for property purchasers in England and Northern Ireland until the end of March 2021. This is good news as we all re-emerge from Coronavirus lockdown and could save you thousands of pounds if you are buying a property.

There has never been a better time to buy a new home with the new Stamp Duty tax break

Our friendly property experts are always happy to help You

Free Phone 0800 2985424

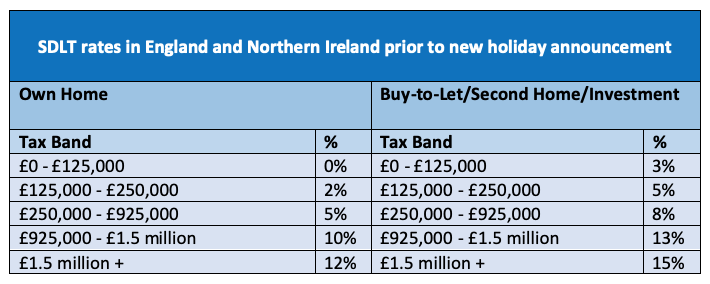

What are the Stamp Duty Land Tax (SDLT) changes?

Rishi Sunak, Chancellor of the Exchequer has given a great boost for those wishing to move home with raising the threshold for Stamp Duty Land Tax (SDLT).

“We need people to feel confident, confident to buy, sell, move and improve that will drive growth, that will create jobs. So, to catalyse the market and boost confidence I have decided today to cut stamp duty.”

Rishi Sunak – Chancellor of the Exchequer

FAQ – Stamp Duty

With all the uncertainty associated with COVID-19 investing in property whether you are moving up the property ladder or downsizing with the Stamp Duty tax break now is a great time to buy for those with a long-term viewpoint.

What you save in Stamp Duty on your new home you could extend the property

We can help you with design options

Free Phone 0800 2985424 today

Changes to Permitted Development (PD)

There are new rules regarding Permitted Development (PD) too.

There are new rights to build upward extensions to certain buildings which forms part to the government's planning system reforms. Permitted Development (PD) rights are divided into two categories:-

- New rights on existing, purpose-built detached blocks of flats and

- New rights on individual homes.

All part of the government's plan to "Build, Build, Build" albeit the changes will rely on "neighbour consultation".

To find out more about Permitted Development call our friendly, knowledgeable experts 0800 298 5424 today

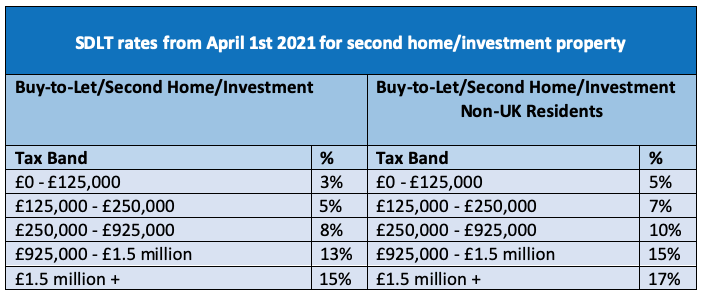

Stamp Duty and Property Investors

Section 24 and new Taxes for property investors can be complex

Call us for the latest information

Free Phone 0800 2985424

Section 24 Changes

Section 24 is a restriction of finance cost relief - before the the new Section 24 rules landlords were able to deduct all their mortgage interest costs as well as other allowable finance costs from their tax bills. The new Section 24 rules gradually reduces this tax relief.

To find out more Free Phone 0800 298 5424 today

Now is a great time to buy with Stamp Duty savings

Book a structural survey with us to ensure you don't buy a problem property

Free Phone 0800 2985424